Failed Payment Recovery

for Subscriptions

Less churn, more revenue, and higher customer LTV for your subscription business. FlexPay recovers all types of failed payments.

Webinar

Learn how to increase payment approvals and lower merchant account risk score.

Revenue Calculator

Calculate annual revenue growth unlocked by FlexPay failed payments recovery.

Unlock More Success

Learn how to optimize decision making using LTV.Reduce involuntary churn with failed payment recovery

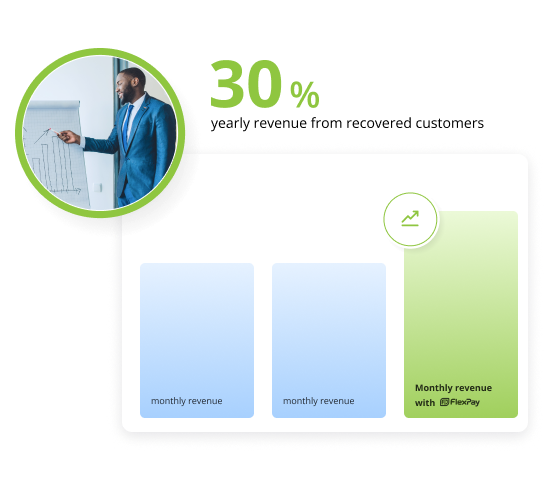

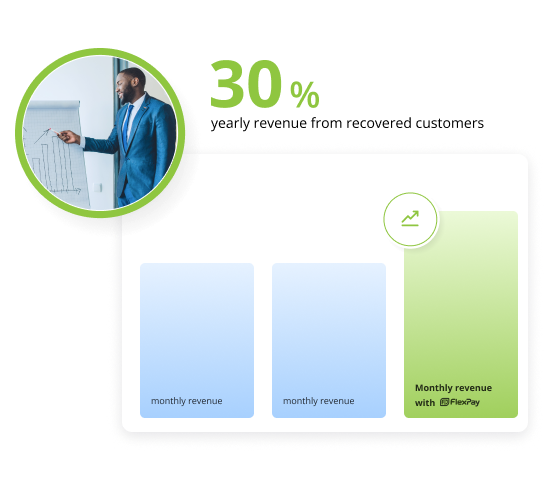

Losing customers to failed payments means less revenue and profit. FlexPay’s clients have earned 30% of their annual revenue from customers we recovered.

Learn how to protect your revenue >

Stop failed payments from causing churn with a recovery system that avoids service disruptions, intelligently navigates customer emotions, and improves retention rates.

Learn best practices to reduce churn >

Recovered customers continue to bill month after month, creating compounded growth and earning more revenue for your business.

Learn how recovery impacts growth >

FlexPay’s Failed Payment Recovery Platform

Recover all types of failed payments and minimize churn

FlexPay’s platform selects the best method to recover each failed payment, delivering the highest subscriber recovery and retention rates. The result is a significant reduction in your involuntary churn, and more revenue from recovered customers.

Invisible Recovery™

Invisible Recovery™

AI-powered Invisible Recovery works directly with the payments system to recover most failed payments quickly without the customer ever knowing their payment was declined.

Engaged Recovery™

Engaged Recovery™

Integrations. The power of a well-connected tech stack

FlexPay integrates with 100+ billing and payment processing systems, making it easy to get started quickly.

How failed payments impact the customer experience

Failed payments can harm customer satisfaction and cause brand damage. Learn what causes failed payments and how to solve them by implementing the ideal failed payment recovery solution.

See how our customers eliminate involuntary churn

Case studies

Alder Holdings, a leading home security provider in the USA, increases subscription rebill rate by 60% using Invisible Recovery and Engaged Recovery by FlexPay.

"FlexPay plays a huge role in capturing revenue for our business."

Jake Palmer

Senior Vice President, Alder Holdings, LLC

Case studies

Truly Free, an eco-friendly cleaning product company, improved their recovery rate by 240% with FlexPay, compared to their in-house recovery system.

"FlexPay recovered thousands of dollars that we would have otherwise thrown away. I trust FlexPay. They go beyond what a normal partner would."

Chad Buckendahl

Chief Growth Officer, Truly Free

Case studies

Invisible Recovery helped ClinicSense, a B2B SaaS company, achieve a 69% recovery improvement, allowing them to fuel their growth.

"The advantage of FlexPay is that I don’t have to think about customers whose payments are failing, I know that they are taking care of it for me."

Daniel Ruscigno

CEO, ClinicSense

Case studies

Hooked on Phonics, an e-learning provider, recovered an additional 45% beyond their in-house recovery, and increased their subscription profitability and customer LTV.

"FlexPay has been a key partner in our effort to improve our subscription profitability. The customers FlexPay has been successfully reactivating for us keep coming back month after month."

Robert Israel

Co-Founder and President